Business News and Covid-19 updates

Welcome to our round up of the latest business and Covid-19 news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you through these tough times.

This week, the positive news is that the average number of new daily Covid-19 cases in the UK has fallen substantially since the start of the year, and vaccinations continue with more than 10.5 million people now having had their second jab and over 33 million their first.

Antivirals Taskforce to roll out innovative home treatments this autumn

The Antivirals Taskforce will identify treatments for UK patients who have been exposed to COVID-19 to stop the infection spreading and speed up recovery time.

The taskforce will search for the most promising novel antiviral medicines that can be taken at home and support their development through clinical trials to ensure they can be rapidly rolled out to patients as early as the autumn.

The taskforce will also look at opportunities to onshore the manufacture of antiviral treatments.

The aim is to have at least 2 effective treatments this year, either in a tablet or capsule form that the public can take at home, following a positive COVID-19 test or exposure to someone with the virus.

The latest figures on the economy

As the lockdown gradually eases, the latest Office for National Statistics (ONS) indicators for the UK economy and society show some positive news about the reopening of the economy.

Estimates for UK seated diner reservations on 12 April 2021 were at 79% of their level seen on the equivalent Monday of 2019. This is the first time the level has exceeded 2% since before the announcement of the latest lockdown in England on 4 January 2021 and coincides with the easing of hospitality restrictions in England on 12 April 2021 (OpenTable).

Total UK online job adverts on 9 April 2021 equalled their February 2020 average level to become the highest level seen since 6 March 2020; this was partly driven by a notable increase to the “catering and hospitality” category, which also reached its highest level since March 2020 (Adzuna).

There were 25,320 new VAT reporters in March 2021, the highest number of new reporters seen since August 2016 when there were 26,440 (Her Majesty’s Revenue and Customs (HMRC)).

In Quarter 1 (Jan to Mar) 2021, a net 1% of 287,880 firms reported an increase in turnover at the total industry level when compared with the previous quarter (Her Majesty’s Revenue and Customs (HMRC)).

Retail footfall was strongest in the West Midlands and the East of England in the week to 10 April 2021, each at 46% of their level in the equivalent week of 2019; retail footfall was weakest in Northern Ireland at 35% of its level in the equivalent week of 2019 (Springboard).

There were 17,881 company incorporations and 5,059 voluntary dissolution applications in the week to 9 April 2021, a 19% increase and 2% decrease from the previous week, respectively (Companies House).

Younger people bear the burden of unemployment

The ONS figures show that over the past year there were over 800,000 payroll jobs lost in the UK and the under 35’s accounted for 80% of losses. The unemployment rate is now dipping thanks to the easing of lockdown, although experts expect it to peak towards the end of the year as the Job Retention Scheme ends and to lag behind the rest of the economy. Overall unemployment is 311,000 higher than a year ago.

The mortgage guarantee scheme

This government has introduced a mortgage guarantee scheme. The scheme is open to new 95% mortgages until 31 December 2022, with participating lenders offering 95% mortgages under the government guarantee from 19 April 2021.

The idea is to support a new generation in realising home ownership. The scheme will increase the availability of 95% Loan-to-value mortgage products, enabling more households to access mortgages without the need for large deposits.

BREXIT NEWS

EU Parliament committee backs Brexit trade deal

The European Union Parliament committees have backed the new trade deal between the 27-nation bloc and the UK pushing it onward to the full legislature for a final vote expected later this month.

Northern Ireland

The news in recent weeks has been dominated by the Northern Ireland (NI) border discussions.

Last month a meeting of the EU-UK body overseeing the NI Brexit arrangements and aimed at resolving issues with the Irish sea border has had mixed reactions amongst NI politicians. No change was reported in extending the request by the UK to extend the border grace period, due to end in April. The UK and business groups have asked the EU for an extension until 2023.

The UK has delayed some Irish Sea border checks without EU agreement and the UK and EU have agreed to intensify talks following a recent meeting of negotiators.

One of the key problems is the check on food and agricultural products entering Northern Ireland and the UK rejects the idea of aligning to EU rules on plant and animal health measures. The UK continues with its “Trusted trader” agreement to reduce border administration controls on traders who have a secure audit trail on their supply chains. We will have to wait and see where the negotiations lead.

Financial services

Reports this week show that many banks and financial institutions have moved thousands of jobs and £1 trillion of assets (approximately 10% of total assets in the UK banking system) out of the UK and into the EU because of Brexit.

Banks, insurers, pension funds and wealth managers had hoped that the UK would secure access to the EU, but the Brexit deal does not cover financial services, one of the UK’s most important industries, and the EU has not yet granted the UK financial services industry “Equivalence”. Equivalence is a system which can be used to grant domestic market access to foreign firms in certain areas of financial services. It’s based on the principle that the countries where they are based have regimes which are ‘equivalent’ in outcome. The EU has not yet reached a decision regarding the UK and requires more information on what the UK will be doing in the future.

Traffic management measures in Kent stood down as trade returns to normal

The government has announced that the Kent Access Permit (KAP) and the M20 moveable barrier will be stood down from 20 April, as delays have been prevented thanks to hauliers arriving at the border prepared.

This comes as freight volumes between the UK and the EU continue to operate at normal levels, with the latest data showing a 46% increase in exports in February. KAPs have been instrumental in avoiding delays at the border, by ensuring that HGV drivers have the correct paperwork before setting off and allowing them to move quickly through the UK’s ports.

Compliance with the KAP obligation from industry has been consistently high, tracking at more than 80% since the middle of January for non-GB hauliers, while the latest data shows the average compliance with the KAP obligation is at 86%.

The removal of the KAP on 20 April will mean less paperwork for hauliers, making it quicker and easier to cross the border, further supporting the already smooth flow of goods from the UK into Europe.

The Kent Resilience Forum has also announced plans to stand down the moveable barrier on 24 April. Specially designed to allow traffic on the M20 to continue in both directions.

Hauliers will have continued access to support on border requirements at any one of 46 information and advice sites across the UK, with the busiest sites remaining in place until at least August. So far, sites have proven to be extremely popular, helping to prepare more than 200,000 hauliers adjust to new border requirements since first opening in November 2020.

We will keep you informed of any further developments in negotiations and changes as they arise.

COVID-19 GOVERNMENT SUPPORT NEWS

Below is our weekly roundup of changes to government support information generally and for businesses, employers and the self-employed.

Coronavirus Job Retention Scheme (CJRS)

April claims

Employers can now submit CJRS claims for periods in April. These must be made by Friday 14 May.

You can claim before, during or after you process your payroll. If you can, it’s best to make a claim once you are sure of the exact number of hours your employees will work so you do not have to amend your claim later.

If you haven’t submitted your claim for March, but believe that you have a reasonable excuse for missing the 14 April deadline, check if you can make a late claim by searching ‘claim for wages’ on GOV.UK. Remember to keep records that support the amount of CJRS grants you claim, in case HMRC needs to check them.

You must pay the associated employee tax and National Insurance contributions to HMRC. If you do not do that, you will need to repay the whole of the CJRS grant to HMRC.

The UK Government will continue to pay 80% of your furloughed employees’ usual wages for the hours not worked, up to a cap of £2,500 per month, to the end of June.

In July, CJRS grants will cover 70% of employees’ usual wages for the hours not worked, up to a cap of £2,187.50. In August and September, this will then reduce to 60% of employees’ usual wages, up to a cap of £1,875.

You will need to pay the difference from July, so that you continue to pay your furloughed employees at least 80% of their usual wages for the hours they do not work during this time, up to a cap of £2,500 per month.

CJRS eligibility from May

If you have employees who have previously been ineligible for the CJRS, as they were not on your payroll on 30 October 2020, they may be eligible for periods from 1 May 2021 onwards.

From May you will be able to claim for eligible employees who were on your PAYE payroll on 2 March 2021. This means you must have made a PAYE Real Time Information (RTI) submission between 20 March 2020 and 2 March 2021, notifying HMRC of earnings for that employee.

You and your employees do not need to have benefitted from the scheme before to make a claim, as long as you meet the eligibility criteria. For more information on eligibility, search ‘check if you can claim for your employees’ wages’ on GOV.UK.

Please contact us for help in submitting your claims, we will continue to support our clients in processing claims until the end of the scheme.

Paying back VAT deferred due to coronavirus

Information has been added on penalties or interest that may be charged if you do not pay in full, or make an arrangement to pay, and how you may still be able to avoid these charges.

The webpage below details how to pay VAT payments deferred between 20 March and 30 June 2020. You can pay now or join the VAT deferral new payment scheme.

If you deferred VAT payments due between 20 March 2020 and 30 June 2020 you can:

- pay the deferred VAT in full now

- join the VAT deferral new payment scheme – the online service is open between 23 February 2021 and 21 June 2021

- contact HMRC on 0800 024 1222 by 30 June 2021 if you need extra help to pay

You may be charged a 5% penalty or interest if you do not pay in full or make an arrangement to pay by 30 June 2021.

Pay your deferred VAT in full

If you were unable to pay in full by 31 March 2021, you may still be able to avoid being charged penalties or interest by either:

- joining the new payment scheme by 21 June 2021

- paying your deferred VAT in full by 30 June 2021

Join the VAT deferral new payment scheme

The VAT deferral new payment scheme is open from 23 February 2021 up to and including 21 June 2021.

The new scheme lets you:

- pay your deferred VAT in equal instalments, interest free

- choose the number of instalments, from 2 to 11 (depending on when you join)

Instalment options available to you

When you decide to join the scheme will determine the maximum number of instalments that are available to you.

The following table sets out the monthly joining deadlines (to allow for Direct Debit processing) and the corresponding number of maximum instalments (including the first payment):

| If you join by | Number of instalments available to you |

| 19 March 2021 | 11 |

| 21 April 2021 | 10 |

| 19 May 2021 | 9 |

| 21 June 2021 | 8 |

How to join

Before joining, you must:

- have your VAT registration number

- create your own Government Gateway account (if you do not already have one)

- submit any outstanding VAT returns from the last 4 years – otherwise you’ll not be able to join the scheme

- correct errors on your VAT returns as soon as possible

- make sure you know how much you owe, including the amount you originally deferred and how much you may have already paid

To use the online service, you must:

- join the scheme yourself, your agent cannot do this for you

- still have deferred VAT to pay

- be up to date with your VAT returns

- join by 21 June 2021

- pay the first instalment when you join

- pay your instalments by Direct Debit (if you want to use the scheme but cannot pay by Direct Debit, there’s an alternative entry route for you)

Join the scheme now

See: Pay VAT deferred due to coronavirus (COVID-19)

Help and support if your business is affected by coronavirus (COVID-19)

A YouTube video about the Coronavirus (COVID-19) Job Retention Scheme and a webinar for Self-Employment Income Support Scheme (SEISS) – fourth grant, have been added to the government guidance.

See: Help and support if your business is affected by coronavirus (COVID-19)

Download a template if you’re claiming for 100 or more employees through the Coronavirus Job Retention Scheme

Complete a template with the details of the employees you’re claiming for and upload this when you claim (for claims on or after 1 July 2020). Templates are in XLS, CSV, ODS, and XLSX formats.

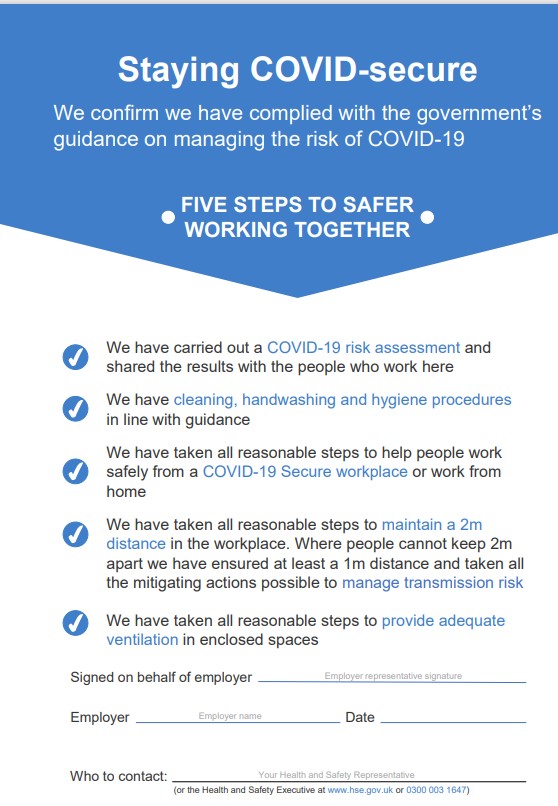

Staying COVID-secure notice

The government has provided businesses with a notice to display to show you have made your workplace COVID-secure.

See: Staying COVID-19 Secure notice

The Red list travel ban countries has been updated to include India.

The countries from which entry to the UK is banned – ‘red list’ countries has been updated.

See: Coronavirus (COVID-19): red list travel ban countries

International road haulage: HGV driver documents

The guidance to check which documents you need to carry if you are the driver or a passenger in a lorry or other heavy goods vehicle (HGV) that crosses international borders has been updated to state you no longer need a Kent Access Permit (KAP) to enter Kent.

See: International road haulage: HGV driver documents – GOV.UK (www.gov.uk)

Private providers of coronavirus testing

The lists of, and information about, approved suppliers of private testing kits for coronavirus (COVID-19) has been updated.

See: Private providers of coronavirus testing – GOV.UK (www.gov.uk)

Providers of day 2 and day 8 coronavirus testing for international arrivals

Information on the 2 tests you must book, pay for and take, during your mandatory 10-day quarantine period after arriving in England, including how to book.

See: Providers of day 2 and day 8 coronavirus testing for international arrivals

European Structural and Investment Funds: Coronavirus (COVID-19) Response

A series of documents and updates regarding the 2014 to 2020 European Structural and Investment Funds Programme and the response to COVID-19.

The Q&A has been updated to provide clarity to a number of existing questions. See the dates next to the questions for updates.

See: European Structural and Investment Funds: Coronavirus (COVID-19) Response

Right to work checks

The guidance for employers carrying out right to work checks during the coronavirus pandemic has been updated as the temporary adjustments introduced because of coronavirus end on 16 May 2021.

The following temporary changes were made on 30 March 2020 and remain in place until 16 May 2021.

- checks can currently be carried out over video calls

- job applicants and existing workers can send scanned documents or a photo of documents for checks using email or a mobile app, rather than sending originals

- employers should use the Employer Checking Service if a prospective or existing employee cannot provide any of the accepted documents

Checks continue to be necessary and you must continue to check the prescribed documents set out in right to work checks: an employer’s guide or use the online right to work checking service. It remains an offence to knowingly employ anyone who does not have the right to work in the UK.

See: Coronavirus (COVID-19): right to work checks

Providing apprenticeships during the coronavirus (COVID-19) outbreak

There is added information to confirm all apprentices in higher education can return to in-person teaching and learning no earlier than 17 May. There is an amended date in the functional skills qualification section and out-of-date information on the exam support service has been removed.

See: Providing apprenticeships during the coronavirus (COVID-19) outbreak

Welcome Back Fund – England

Guidance to help local authorities and partners to deliver activities supported through the Welcome Back Fund. This funding builds on the Reopening High Streets Safely Fund announced in May 2020.

The Welcome Back Fund is providing councils across England a share of £56 million from the European Regional Development Fund (ERDF), to support the safe return to high streets and help build back better, from the pandemic. This funding builds on the £50 million Reopening High Street Safely Fund (RHSSF) allocated to councils in 2020 and forms part of the wider support government is providing to communities and businesses.

This guidance builds on and replaces the previously published RHSSF guidance. The purpose of this guidance is to provide details of the activities that can be supported through the Fund and an overview of how it will be administered, as well as key ERDF contractual requirements.

See: New raft of measures to prepare our high streets and seaside resorts for summer

Working safely during coronavirus (COVID-19) – England

These 14 guides cover a range of different types of work. Many businesses operate more than one type of workplace, such as an office, factory and fleet of vehicles. You may need to use more than one of these guides as you think through what you need to do to keep people safe. Priority actions are outlined at the top of each guide. New guidance has been provided for:

- Heritage locations – Updated to reflect Step 2 of the roadmap

- Performing arts – Updated to reflect Step 2 of the roadmap.

For more information , Book a Free Consultation

Need Accountancy Support?

For information on bespoke training, or if you have any other questions for Makesworth Accountant, please fill in your details below

148

148