Changes to the Coronavirus Job Retention Scheme

CHANGES TO THE CORONAVIRUS JOB RETENTION SCHEME

This guidance page was updated on 12 June to include details on how the scheme will change from 1 July. The first time you will be able to make claims for days in July will be 1 July, you cannot claim for periods in July before this point. 31 July is the last day that you can submit claims for periods ending on or before 30 June.

The Coronavirus Job Retention Scheme will close on 31 October 2020.

From 1 July, employers can bring furloughed employees back to work for any amount of time and any shift pattern, while still being able to claim CJRS grant for the hours not worked.

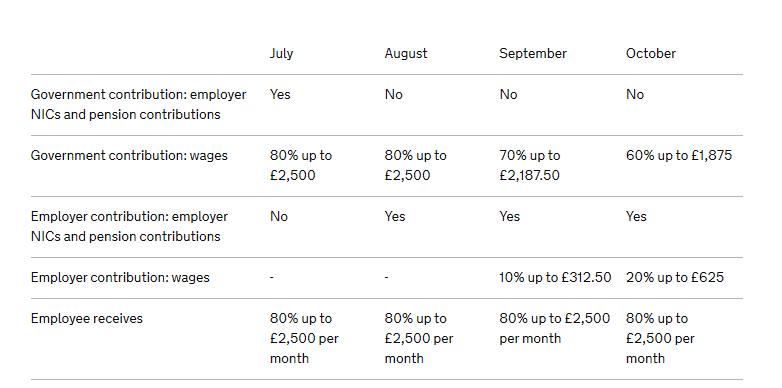

From 1 August 2020, the level of grant will be reduced each month. To be eligible for the grant employers must pay furloughed employees 80% of their wages, up to a cap of £2,500 per month for the time they are being furloughed.

The timetable for changes to the scheme is set out below. Wage caps are proportional to the hours an employee is furloughed. For example, an employee is entitled to 60% of the £2,500 cap if they are placed on furlough for 60% of their usual hours:

- There are no changes to grant levels in June.

- For June and July, the government will pay 80% of wages up to a cap of £2,500 for the hours the employee is on furlough, as well as employer National Insurance Contributions (ER NICS) and pension contributions for the hours the employee is on furlough. Employers will have to pay employees for the hours they work.

- For August, the government will pay 80% of wages up to a cap of £2,500 for the hours an employee is on furlough and employers will pay ER NICs and pension contributions for the hours the employee is on furlough.

- For September, the government will pay 70% of wages up to a cap of £2,187.50 for the hours the employee is on furlough. Employers will pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

- For October, the government will pay 60% of wages up to a cap of £1,875 for the hours the employee is on furlough. Employers will pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

Employers will continue to able to choose to top up employee wages above the 80% total and £2,500 cap for the hours not worked at their own expense if they wish. Employers will have to pay their employees for the hours worked.

The table shows Government contribution, required employer contribution and amount employee receives where the employee is furloughed 100% of the time.

Wage caps are proportional to the house not worked.

See:

Read Article

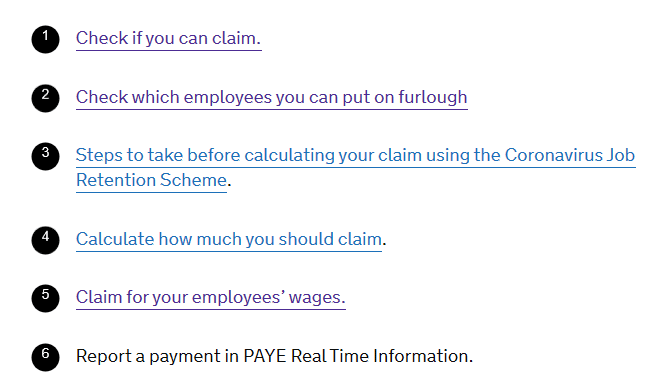

TO MAKE A CJRS CLAIM:

See:

https://www.gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme

To make a claim, you will need:

- to be registered for PAYE online

- your UK bank account number and sort code (only provide bank account details where a BACS payment can be accepted)

- the billing address on your bank account (this is the address on your bank statements)

- your employer PAYE scheme reference number

- the number of employees being furloughed

- each employee’s National Insurance number (you will need to search for their number if you do not have it or contact HMRC if your employee does not have a number)

- each employee’s payroll or employee number (optional)

- the start date and end date of the claim

- the full amounts that you are claiming for including:

- employee wages

- employer National Insurance contributions (for claims up to 31 July)

- employer minimum pension contributions (for claims up to 31 July)

- your phone number

- contact name

You also need to provide either:

- your name (or the employer’s name if you are an agent)

- your Corporation Tax unique taxpayer reference

- your Self-Assessment unique taxpayer reference

- your company registration number

If you are claiming for employees who are flexibly furloughed, you’ll need to have agreed the furlough arrangement with the employee (or reached a collective agreement with a trade union) and keep a written agreement that confirms the furlough arrangement.

For the claim period you will also need:

- the number of usual hours your employee would work in the claim period

- the number of hours your employee has or will work in the claim period

- you will also need to keep a record of the number of furloughed hours your employee has been furloughed in the claim period

Using an agent (your accountant) to do PAYE online:

If you use an agent who is authorised to do PAYE online for you, they will be able to claim on your behalf.

If you would like to use an agent, but do not have one authorised to do PAYE online for you, you can do that by accessing your HMRC online services and selecting ‘Manage Account’.

You must be enrolled in PAYE online for employers to do this and will need to ask your agent for their agent ID. Your agent can get this from their HMRC online service for agents by selecting ‘authorise client.’

You can also use this service to remove authorisation from your agent if you do not want it to continue after they have submitted your claim(s).

If an agent makes a claim on your behalf you will need to tell them which bank account you would like the grant to be paid into. You must only provide bank details where a BACS payment can be accepted.

If you are putting 100 or more employees on furlough

If you are claiming for 100 or more furloughed employees, you will need to upload a file containing the following for each employee:

- full name

- National Insurance number

- payroll number (optional)

- furlough start date

- furlough end date (if known)

- full amount claimed

If you are flexibly furloughing any of these employees, you will also need to include:

- hours they actually worked in the claim period

- usual hours worked in the claim period

You will need to ensure that you:

- provide only the employee information requested here – if you provide more or less information than required, you may risk delaying your payment and/or be asked to provide the information again

- submit one line per employee for the whole period

- do not break up the calculation into multiple periods within the claim

- do not split data by contract type (for example, those paid weekly and monthly should be claimed for together)

- upload your file as an .xls, .xlsx, .csv or .ods

HMRC will provide a file upload template to complete for claim periods starting on or after 1 July. Templates will available by that date and will be available in .xls, .xlsx, .csv and .ods formats.

After you have claimed

Once you have claimed, you will get a claim reference number. HMRC will then check that your claim is correct and pay the claim amount by BACs into your bank account within 6 working days.

You must:

- keep a copy of all records for 6 years, including:

- the amount claimed and claim period for each employee

- the claim reference number for your records

- your calculations in case HMRC need more information about your claim

- for employees you flexibly furloughed, usual hours worked including any calculations that were required

- for employees you flexibly furloughed, actual hours worked

- tell your employees that you have made a claim and that they do not need to take any more action

- pay your employee their wages if you have not already

You must pay the full amount you are claiming to your employee and pay the associated employee tax and National Insurance Contributions, even if your company is in administration. If you are not able to do that, you will need to repay the money back to HMRC. The same applies in relation to employer NICs and pension contributions you claim regarding your employee. The full amount you claim in respect of these must be paid or you will need to repay the money back to HMRC.

Employers cannot enter into any transaction with the worker which reduces the wages below the amount claimed. This includes any administration charge, fees or other costs in connection with the employment. Where an employee had authorised their employer to make deductions from their salary, these deductions can continue while the employee is furloughed provided that these deductions are not administration charges, fees or other costs in connection with the employment.

If you make an error when claiming

If you have made an error in a claim that has resulted in an overclaimed amount, you must pay this back to HMRC.

You can now tell us about an overclaimed amount as part of your next claim. You will be asked when making your claim whether you need to adjust the amount down to take account of a previous error. Your new claim amount will be reduced to reflect this. You do not need to take further action but should keep a record of this adjustment for six years.

If you have made an error that has resulted in an underclaimed amount, you should contact HMRC to amend your claim. As you are increasing the amount of your claim, we need to conduct additional checks.

If you have made an error in a claim and do not plan to submit further claims, we are working on a process that will allow you to let us know about your error and pay back any amounts that you have overclaimed. We will update guidance when this is available.

When the government ends the scheme

When the scheme closes on October 31, you must decide, depending on your circumstances, as to whether employees can return to their normal hours. If not, it may be necessary to consider reducing their hours, or a termination of employment (redundancy). Normal redundancy rules apply to furloughed employees.

Tax Treatment of the Coronavirus Job Retention Grant

Payments received by a business under the scheme are made to offset these deductible revenue costs. They must therefore be included as income in the business’s calculation of its taxable profits for Income Tax and Corporation Tax purposes, in accordance with normal principles.

Businesses can deduct employment costs as normal when calculating taxable profits for Income Tax and Corporation Tax purposes.

Individuals with employees that are not employed as part of a business (such as nannies or other domestic staff) are not taxable on grants received under the scheme. Domestic staff are subject to Income Tax and NICs on their wages as normal.

How to report grant payments in Real Time Information

Find out how to report Coronavirus Job Retention Scheme grant payments on Real-Time Information submissions.

See:

https://www.gov.uk/guidance/claim-for-wages-through-the-coronavirus-job-retention-scheme

If you have claimed a grant through the Coronavirus Job Retention Scheme, you should check if you need to report payments on the PAYE Real Time Information system, as this will depend on whether you are using the grant to:

- pay wages

- reimburse wages that you have already paid

If you are claiming a grant through the scheme, the steps to do this are:

If you are using the grant to pay wages

Any grant paid to you, is to be used to pay wages to your furloughed employees and should be treated in the same way as any wage payment and is subject to all payroll deductions.

You should pay employees on their contractual payment date so that employees receiving Universal Credit are not affected.

The grant paid is included in pay reported to HMRC via your payroll filing software of a Full Payment Submission, on or before the date that it is paid to your employees.

If you have paid your employees and submitted your Real Time Information submission early

If you have already paid your employees before their contractual payment date, the next time you pay them, make sure it is on their normal contractual payment date.

You should submit the Full Payment Submission on or before the date that you make the payment.

If you are using the grant to reimburse wages already paid

If you have continued to pay your employees during a period of furlough, in advance of receiving any payments under the scheme, you do not need to make another Full Payment Submission for this amount. This is because the furlough grant is reimbursing the wages you have already paid out and already reported.

If you pay the full amount of an employee’s normal wage during furlough

If you choose to top up employee wages above the scheme grant, that is your choice and at your own expense.

You must deduct tax and National Insurance Contributions on the full amount paid and report this payment via a Full Payment Submission on or before the pay date. When the grant is paid by HMRC, it will reimburse the wages already paid.

You do not need to make another Full Payment Submission for this amount.

If you have not paid your employees’ full wages yet and If you have not paid any of your employees any wage payments in a tax month

You must submit an Employer Payment Submission stating you have not paid any employees in that tax month. The Employer Payment Submission should be sent no later than 19th of the following tax month where possible. Do not submit a nil Full Payment Submission.

If you only pay your employees part of their normal wage until the grant payment is received

You must operate PAYE, deducting any tax and National Insurance contributions due on the reduced salary payment amounts and you must report these payments by sending a Full Payment Submission to HMRC, on or before the payment date.

You must only send a Full Payment Submission reporting the payments you actually made. When you pay the remaining wages to your employees after receiving the grant payment, you must send another Full Payment Submission showing that payment.

If you are making a payment to your employees for March or April

If you are making a payment for March and April in your employee’s April wage, you must deduct tax and National Insurance Contributions on that full amount.

You must not backdate the March payment as if it was paid in March.

If you reported wages to HMRC in March 2020 that you did not pay to your employees

The Full Payment Submission must only include wages you have actually paid to your employees.

You will need to submit an Earlier Year Update or a Year-To-Date Full Payment Submission that shows what you paid in wages. When you receive the grant, you should pay your employees on their contractual payment date for the current tax month. You should also submit a Full Payment Submission for 2020 – 2021, on or before the date you make the payments to your employees.

Contacting HMRC

HMRC state they are receiving very high numbers of calls and warn contacting HMRC unnecessarily puts essential public services at risk during these challenging times.

They advise not to contact HMRC unless it has been more than 10 working days since you made the claim and you have not received it in that time.

Get help online

Use HMRC’s digital assistant to find more information about the coronavirus support schemes.

See:

https://www.tax.service.gov.uk/ask-hmrc/virtual-assistant/support-for-coronavirus

You can also contact HMRC about the Coronavirus Job Retention Scheme, if you cannot get the help you need online: 0800 024 1222

Opening times:

Monday to Friday: 8am to 4pm

Closed on weekends and bank holidays.

Need Accountancy Support?

For information on bespoke training, or if you have any other questions for Makesworth Accountant, please fill in your details below

151

151