Reducing penalties for late disclosure of income

You can use the Digital Disclosure Service (DDS), if you need to make a voluntary disclosure of income or other taxable events that have not previously been reported to HMRC.

Other current HMRC campaigns that facilitate disclosure by taxpayers, include the Card Transaction Programme – a disclosure opportunity for businesses that accept card payments and have not paid the right amount of tax due – and the Let Property Campaign for landlords who have undeclared income from residential property lettings in the UK or abroad.

There are three main stages to making a disclosure, notifying HMRC that you wish to make a disclosure, preparing an actual disclosure (within 90 days from the date HMRC acknowledged your notification), and making a formal offer together with payment.

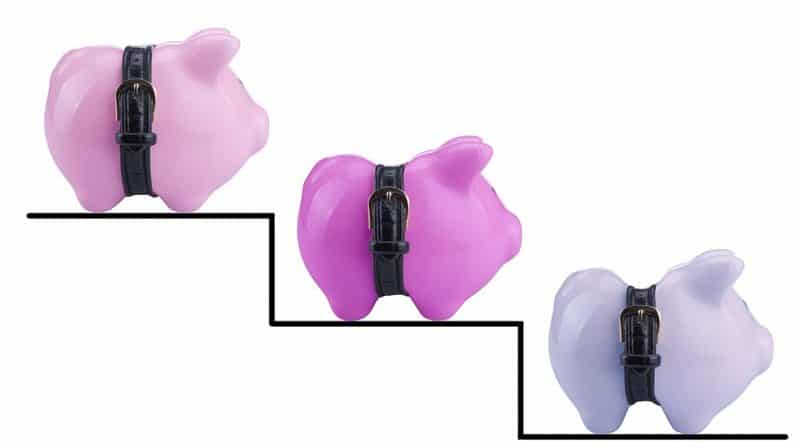

Avoiding or reducing penalty charges

It is important to remember that there are usually lower penalties if you make a voluntary disclosure. The actual rate of the penalties will vary depending on the specific circumstances and in some limited cases there may be no penalties due. There are higher penalties for offshore liabilities. For undisclosed liabilities, the penalties could be up to 100% of the unpaid liabilities if the income or gain arose in the UK, or up to 200% for offshore liabilities.

The process of reporting income and gains in this way needs to be handled carefully, and we recommend that readers who are mindful to “bring matters up-to-date” take professional advice. Please call if you are considering your options, we can help you through the disclosure formalities.

For more information, Book a Free Consultation

Need Accountancy Support?

For information on bespoke training, or if you have any other questions for Makesworth Accountant, please fill in your details below

148

148