The Covid-19 Vaccine Programme has a started!

This week we can reflect on the good news of the first vaccines arriving, being distributed and administered to people in the UK. The Government plans state the aim of the COVID-19 vaccination programme is to protect those who are at most risk from serious illness or death from COVID-19.

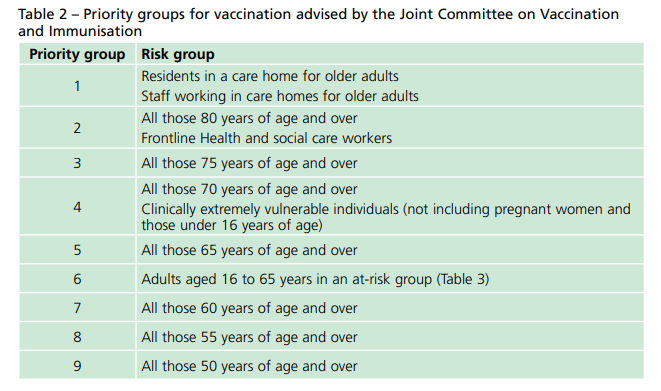

The Joint Committee of Vaccination and Immunisation (JCVI) have set out a prioritisation for persons at risk. JCVI ranked the eligible groups according to risk, largely based on prevention of COVID-19-specific mortality.

Priority groups 4 and 6 also include clinical risk groups. The list can be seen here:

The Government has published guidance entitled “Why you have to wait for your COVID-19 vaccine” which details age groups and eligible groups in detail. It also outlines the fact that the COVID-19 vaccines will become available as they are approved for use and as each batch is manufactured. So every dose is needed to protect those at highest risk. People will be called in as soon as there is enough vaccine available.

See:

The guidance states:

“Some people who are housebound or live in a care home and who can’t get to a local vaccination centre may have to wait for supply of the right type of vaccine. This is because only some vaccines can be transported between people’s homes.

Vaccines will be offered in a range of settings. Some vaccination teams will visit people to offer the vaccine, for example in care homes, other people may have to go to the nearest centre. Because some of the vaccine has to be stored in a very low temperature freezer, you may not be able to get the vaccine in your normal GP surgery.”

In a year of doubt, uncertainty and unprecedented fear for us all, it is certainly good news that there is a plan for the vaccination of those most vulnerable to the virus. Let’s hope the development of new vaccines and their distribution continues and that sometime in 2021 we can return to normal!

WHAT HOPE FOR THE RECOVERY?

The latest economic indicators for the UK economy from the Office for National Statistics (ONS) show 77% of UK businesses are currently trading, with 14% of trading business’ workforce on furlough leave. Their latest figures show that monthly gross domestic product (GDP) rose by 0.4% during October 2020 but was still 7.9% below February 2020 levels.

Output is expected to shrink again in November after England’s second shutdown forced many businesses to close.

October 2020 saw the sixth consecutive month of growth, but the rate of recovery has slowed each month since the largest rise of 9.1% in June 2020. Across services, the monthly growth was driven by health, wholesale, retail and motor trades, and education, while accommodation and food and beverage service activities declined. Within manufacturing

there was widespread growth, led by a rise of 6.8% in motor vehicle production. Monthly construction output growth slowed to 1.0% in October 2020, the sixth consecutive month of growth but the lowest rise in that time, with the level of construction output in October 2020 still 6.4% below the February 2020 level.

The figures are gradually improving although it is going to be a long haul. It is clear the hospitality, travel, arts and retail sectors are hardest hit and whilst there are regional grants to support them we believe these sectors will take the longer to recover.

A “No Deal” Brexit will have a negative impact on the economy in early 2021 and any recovery will take longer as a result. The Confederation of British Industry (CBI) predict the UK won’t get back to its pre-pandemic level until the end of 2022 and if there is “No Deal” this could take up to 2024.

Despite the pandemic and the possibility of “No Deal”, we still continue to be impressed with the resilience of our clients and how they have energetically repurposed or pivoted their businesses into new areas, products and services. Please do talk to us about planning for 2021 and beyond, we have considerable experience in helping businesses project their figures forward and perform “What if” analysis to look at a range of scenarios.

GOVERNMENT SUPPORT AND GUIDANCE

The Government has issued new guidance and here is a summary of the main areas we have seen this week:

Jobs that qualify for travel exemptions

Some people don’t have to fill in a passenger locator form or self-isolate on arrival in the UK, because of the jobs they do. This guidance lists the jobs that qualify for an exemption and tells people:

- if they need to self-isolate

- if they need to complete a passenger locator form

- any conditions they will need to meet or evidence they will need to show

New Changes have been made with exemptions added for certain senior executives, journalists, newly signed elite sportspersons, performing arts professionals, television production.

Business evictions ban extended until March

Business owners affected by the pandemic will be protected from eviction until the end of March 2021.

The Government states: “The majority of commercial landlords have shown flexibility, understanding and commitment to protect businesses during an exceptionally challenging time.

This final extension to protections from the threat of eviction will give landlords and tenants 3 months to come to an agreement on unpaid rent. The government is clear that where businesses can pay any or all of their rent, they should do so.”

Further guidance to support negotiations between landlords and tenants will also be published shortly.

Temporary relaxation of the enforcement of the EU drivers’ hours rules: delivery of essential items to retailers

In response to pressures on local and national supply chains, the Department for Transport (DfT) has, pursuant to Article 14(2) of Regulation (EC) No 561/2006, introduced a temporary and limited urgent relaxation of the enforcement of EU drivers’ hours rules in England, Scotland and Wales.

This is as a consequence of urgent and exceptional issues related to certain road transport operations, including in the context of port congestion, unusual demand patterns and the effects of coronavirus (COVID-19)-related restrictions on supply chains and demand on them.

The relaxation applies to anyone driving within Great Britain under the EU drivers’ hours rules involved in the transport of:

- Food and other essential goods from ports within Great Britain. This includes driving of mixed loads with a significant content of such goods. Essential goods include category 1 goods. Where transports of other goods are required to enable category 1 goods to be moved out of ports, the relaxation is also applicable.

- Food and other essential goods for retail, including mixed loads with a significant content of such goods. This category includes the following journeys:

- distribution centre to stores (or fulfilment centre)

- from manufacturer or supplier to distribution centre (including backhaul collections)

- from manufacturer or supplier to store (or fulfilment centre)

- between distribution centres and transport hub trunking

- transport hub deliveries to stores

This relaxation does not apply to drivers undertaking deliveries directly to consumers.

It is permitted for a driver using this relaxation to drive outside Great Britain during the period of this relaxation.

The EU drivers’ hours rules can be temporarily relaxed as follows:

- replacement of the requirement to take a full weekly rest period of 45 hours in a 2-week period with an alternative pattern of weekly rest periods specified below. This enables 2 consecutive reduced weekly rest periods to be taken on the run-up to Christmas

- that in a 4-week period beginning on 10 December 2020, a driver can take 2 consecutive reduced weekly rest periods of at least 24 hours (allowing them to work two 6-day weeks); even if the week before the driver had already taken a reduced weekly rest

- however, any reduction in weekly rest shall be compensated for in the normal way by an equivalent period of rest taken before the end of the third week following the week in question

- in addition, any rest taken as compensation for a reduced weekly rest period (other than the initial reduced weekly rest period) shall be attached to a regular weekly rest period of at least 45 hours (which can be split over 2 regular weekly rest periods)

- increasing the fortnightly driving limit from 90 hours to 99 hours

This relaxation must not be used in combination with existing rules for international driving, which allow for 2 consecutive reduced weekly rest breaks in certain circumstances. It is not recommended this relaxation be used for drivers engaged partly in international journeys.

Exceptional costs associated with Coronavirus

These instructions are for schools, academies, local authorities and multi-academy trusts.

The guidance has been updated to include information about how to claim for extra funding during the coronavirus (COVID-19) emergency for costs incurred between March and the end of the summer term.

England- Local Restrictions Support Grants (LRSG) and Additional Restrictions Grant (ARG): guidance for local authorities

This is guidance for local authorities on paying grants to support businesses during the November to December 2020 national lockdown and periods of local restrictions.

Change made: LRSG (Open) Version 2: applicable from 2 December 2020 onwards – guidance for local authorities published.

Working safely during coronavirus

Changes have been made for Restaurants, pubs, bars and takeaway services – Updated guidance for England on Tier 3 restrictions to clarify that customers can enter the premises to place or collect any type of order between 5am and 11pm. See the ‘What’s changed’ section for further information.

Shops and branches – Updated guidance to clarify that betting shops must keep a record of all customers, visitors and staff and that workplace canteens open to staff only do not need to collect data for NHS Test and Trace. See the ‘What’s changed’ section for further information.

England- Christmas Support Payment for wet-led pubs

The government has issued new guidance for local authorities on paying grants to support businesses during the November to December 2020 national lockdown and periods of local restrictions to include Christmas Support Payment for wet-led pubs.

England- Tier 1: Medium alert

What you can and cannot do in an area in Tier 1 of local restrictions has been updated with information on visiting venues and added link to guidance on which businesses and venues are permitted to be open.

See:

England- Tier 2: High alert

What you can and cannot do in an area in Tier 2 of local restrictions has been updated information on visiting venues and added link to guidance on which businesses and venues are permitted to be open.

For more information, Book a Free Consultation

Need Accountancy Support?

For information on bespoke training, or if you have any other questions for Makesworth Accountant, please fill in your details below

148

148