What does the Queen’s Speech mean for employment law?

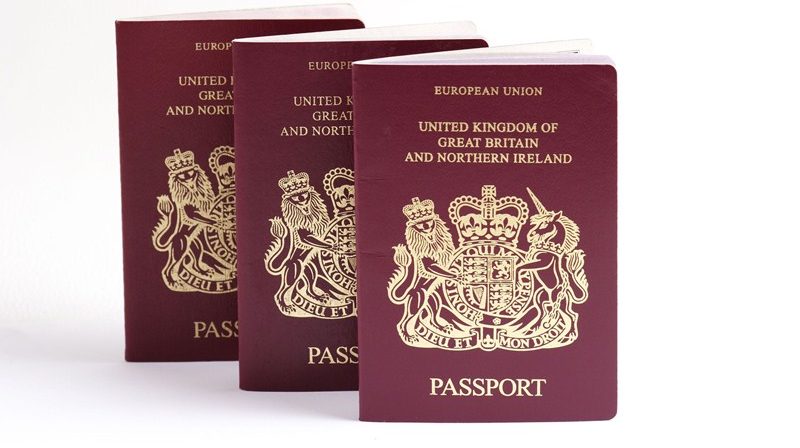

The Queen’s Speech 2019 outlined several Brexit-related Bills, including an Immigration and Social Security Co-ordination (EU Withdrawal) Bill, designed to end free movement within the UK after Brexit and to lay the foundation for a new, modern and global immigration system. The Bill will also reaffirm the government’s commitment to the right to remain for resident EU citizens “who have built their lives here in the UK”. The main elements of the Bill are:

- Ending the free movement of EU citizens under UK law

- The power to align the treatment of EU citizens arriving after January 2021 with non-EU citizens, and to maintain the treatment of EU citizens resident in the UK before exit day

- Clarifying the immigration status of Irish citizens in the UK once the free movement rules are removed from UK law

- Confirming the deadline for applications to be made under the EU Settlement Scheme

- Giving EU citizens and their family members who apply a right of appeal against EU Settlement Scheme decisions.

Should the UK leave the EU without a deal, EU citizens moving to the UK after Brexit and on or before 31 December 2020 will be able to apply for a temporary immigration status, called European Temporary Leave to Remain, which will carry them into the new skills-based immigration system from 2021.

Looking specifically at employment law, the reform agenda was modest as the Speech included only one Bill. The Employment (Allocation of Tips) Bill will make sure that tips are kept in full by, or distributed fairly and transparently to, “those who work hard to earn them”. The main elements of the Bill are:

- A legal obligation on employers to pass on all tips, gratuities and service charges to workers without any deductions

- A legal obligation on employers to distribute tips in a fair and transparent manner, where employers have control or significant influence over the distribution of tips

- The requirement for an employer to follow a statutory Code of Practice when distributing tips – the Code will set out the principles of fair and transparent distribution of tips.

The government did, however, also confirm that it would continue to deliver on the commitments set out in the Good Work Plan, ensuring that UK employment practices keep pace with modern ways of working. In this regard, it committed to:

- Increasing fairness and flexibility in the labour market by stopping employers and workers experiencing significantly different outcomes from flexible forms of working

- Strengthening workers’ ability to get redress for poor treatment, including by improving the enforcement system

- Increasing transparency and clarity for workers and employers, taking account of modern working relationships

- Giving better support to working families and taking further steps to promote workplace participation for all

- Increasing the national living wage (NLW) to two-thirds of median hourly earnings and lowering the age threshold for those who qualify from 25 to 21 within the next five years, with further details to be set out at the next Budget (due to be delivered on 6 November 2019 if the UK leaves the EU with a deal).

For more information on Queen’s Speech for employment law, Book a Free Consultation

Need Accountancy Support?

For information on bespoke training, or if you have any other questions for Makesworth Accountant, please fill in your details below

151

151