The Corona virus Business Interruption Loan Scheme (CBILS) Update

Background

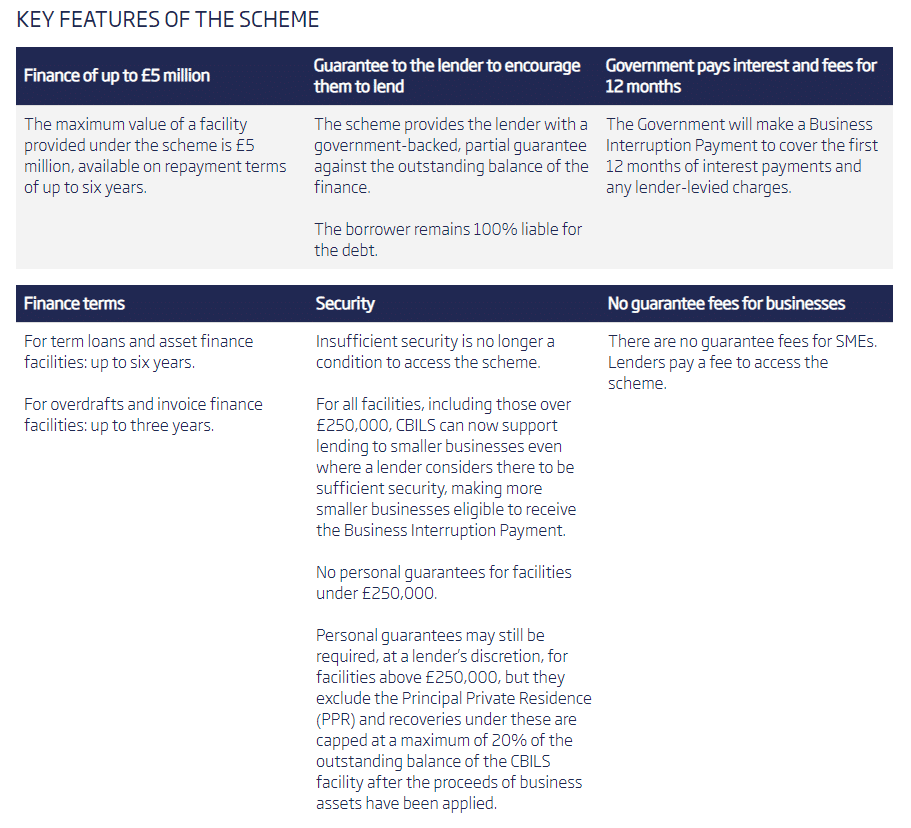

CBILS is a scheme introduced by the UK Government to provide finance to small and medium-sized businesses which have been impacted by COVID-19.

The scheme covers different finance products (term loans, overdrafts, invoice finance and asset finance) and are covered by an 80% government guarantee.

CBILS was initially announced in the budget on 11 March 2020 and updated in a separate announcement on 3 April 2020. The first few weeks of the scheme have suffered with some delays and uncertainty.

It is expected that CBILS will be widely used as many businesses have been significantly impacted by Covid-19 and are struggling with cash flow.

The scheme is being administered through the British Business Bank (who were founded in 2008 as a response to the Global Financial Crisis). The BBB has two key roles:

- Approving lenders so they can offer the scheme to businesses. There are currently 47 approved lenders – more are expected to be added in the coming weeks; and

- Registering the loans provided by the approved lenders so that each loan is being covered by the government guarantee.

Overview of the scheme: https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils/

What exactly is CBILS?

Given that CBILS covers four different types of finance (term loan, asset finance, overdraft and invoice finance) it is important to understand what these are and then decide the best offering for a specific business and need.

The following sectors are not eligible for CBILS:

- Banks, insurers and reinsurers (but not insurance brokers)

- Public-sector bodies

- Further-education establishments, if they are grant-funded

- State-funded primary and secondary schools

The scheme may also be relevant for start-up businesses, however, the BBB Start Up Loans program which provides loans from £500 to £25,000 may be more suitable. More details can be found here: https://www.startuploans.co.uk/

Changes announced on 3 April

The Chancellor, Rishi Sunak announced some important changes to CBILS on 3 April which means that some business applications which were unsuccessful could now be re-submitted and hopefully approved.

The key changes were:

- Initially, if a business were able to qualify for a commercial finance package (i.e. a lender would have given the business a loan / overdraft etc. without needing the government’s guarantee) then they were ineligible for CBILS. As of 3 April, this has been removed so every small business can now apply for a CBILS facility.

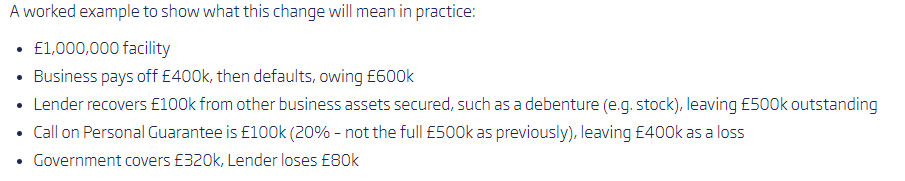

- Lenders have also had to stop requiring business owners to sign personal guarantees (PGs) on facilities below £250k. For facilities above £250k, lenders may require PGs, but these are capped at 20% of the remaining facility balance after the proceeds of business assets have been applied. The PG is also not permitted to include the Principal Private Residence (i.e. house) of the business owner. See the following worked example from the BBB for how the PG would work in practice:

- Along with the above announcements, there was a new scheme launched for larger businesses called the Coronavirus Large Business Interruption Loan Scheme (CLBILS). This will provide loans of up to £25m to businesses with an annual turnover between £45m and £500m. CLBILS is not active yet but we understand will be launched later in April. More details can be found here: https://www.gov.uk/guidance/apply-for-the-coronavirus-large-business-interruption-loan-scheme

Banks / Lenders

The scheme has 47 approved lenders (as of 15th April 2020), details of which can be found here: https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils-2/current-accredited-lenders-and-partners/

These lenders range from high-street banks, to challenger banks, asset-based lenders and smaller specialist local lenders.

Not all of these lenders can provide all of the products (e.g. term loans, overdrafts etc) and certain lenders will have additional criteria beyond those described above. For example, the newly approved Oak North Bank offers CBILS loans with a minimum loan amount of £500k and Skipton Business Finance will only provide support for invoice financing.

It is recommended for a business to approach their current bank / lender in the first instance to make a CBILS application and that these applications are made either through the lender’s website or telephone.

Businesses may also consider approaching other lenders if they are unable to access the finance they need. If a business has been rejected from a CBILS application with one approved finance provider, they are still able to apply with another finance provider.

The key information that needs to be provided for finance applications are shown below. We as your accountants can help you prepare and submit the supplication to the lender:

- Historical accounts

- Management accounts

- Cash flow forecast for at least 12 months

- Business plan

- Details of assets

- Details of other financing in the business

Lenders will have an annual claim limit from the government – which doesn’t seem to have been published – meaning that it is possible the actual government guaranteed could be below 80% at any one time.

The lenders still take the risk on 20% of the financing provided and therefore it is expected will use full credit processes to work through applications. Whilst this makes sense for the lenders it is causing delays in accessing the funds as the workload on the credit teams in these lenders are hugely stretched – whilst at the same time they are trying to manage their current loans book and support existing borrowers.

The loan process typically involves:

- Step 1: You submit an application (typically online);

- Step 2: An account manager reaches out to you to learn more about your business, collect documentation and find terms that suit your need.

- Step 3: Underwriters review your application and make a decision. They may contact you or your accountant if they have additional questions.

- Step 4: You accept a loan offer and you will be fully funded.

The time it takes from application to receiving an approval and getting the cash in the bank account will vary between different lenders. Typically, the larger banks have more structured (and slower) credit processes, however, if the bank knows your business well it may be a quicker process.

With 20% exposure the banks are expected to take security where possible and this will often include PGs – so business owners should be prepared for this and to think through the impact this may have on their personal finances.

Current status

Below are a few key thoughts on the current and future situation surrounding CBILS:

- Current status – The CBILS scheme went live on 23rd March and is initially being run for 6 months. As of 3 April, 130,000 enquiries had been made for CBILS by small businesses and 983 loans had been approved.

- Reapplying – The expanded scheme (post the April 3rd changes) went live on 6th Therefore, if a business was rejected before 6th April then it is recommended, they consider re-applying, especially if the application was rejected because there were commercial financing options available at the time.

- Personal guarantees – It is a big ask for a business owner, who has seen their company all but stop in a matter of days, to then write a personal guarantee. However, it may be the only way a lender can get comfortable in providing the finance.

- Existing financing – If a business has existing finance in place these often include negative pledges – effectively restricting the company from taking out any more finance without existing lender approval. Also, there is the question of which financing ranks higher in the capital structure if a CBILS loan is taken on by a company with existing debt.

- Confidence of taking on extra leverage – Every business owner is facing greater uncertainty and there is a question about whether the principal and interest repayments (when they kick in) on CBILS loans can be met.

NEXT STEPS

Businesses considering whether to apply for a CBILS loan should speak to us to determine the offering which best fits the business. We can also help collect the required information and make the loan application on your behalf with the bank.

Helpful FAQ on BBB website which may answer some of your questions: https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils-2/cbils-faqs-for-smes/

Note: As of 17 April 2020, some banks have not updated their websites or provided details of the Coronavirus Business Interruption Loan Scheme. Please keep your eye out for updates.

Need Accountancy Support?

For information on bespoke training, or if you have any other questions for Makesworth Accountant, please fill in your details below

148

148